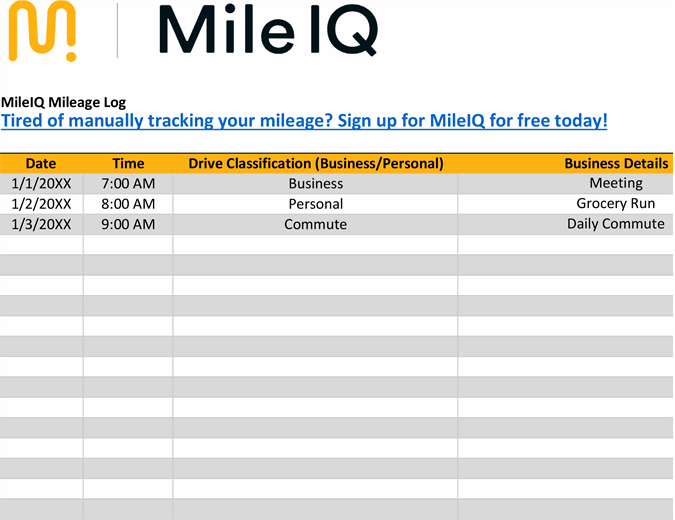

Excel Mileage Log For Taxes. Is there a template for mileage log in excel? Our free downloadable excel mileage log will help you track your mileage manually and contains all the information you’ll need to meet irs standards.

The templates help you track the number of miles your vehicle has traveled in a specific time period.

How to track mileage for taxes and reimbursement? This template will calculate the value of your business trips based on this figure. Using the standard mileage rate of 54.5 cents per business mile driven, this template will calculate your deduction per trip, making it easy to calculate your total deduction when it. Mileage log and expense report.

0 comments:

Post a Comment